2025 Irs Form 8949 - IRS Form 8949 walkthrough (Sales and Other Dispositions of Capital, Sales and other dispositions of capital assets. I have the transactions already in, but 2023 is not in the drop down. While you’ve probably sold plenty of capital assets, you may have never heard of form 8949.

IRS Form 8949 walkthrough (Sales and Other Dispositions of Capital, Sales and other dispositions of capital assets. I have the transactions already in, but 2023 is not in the drop down.

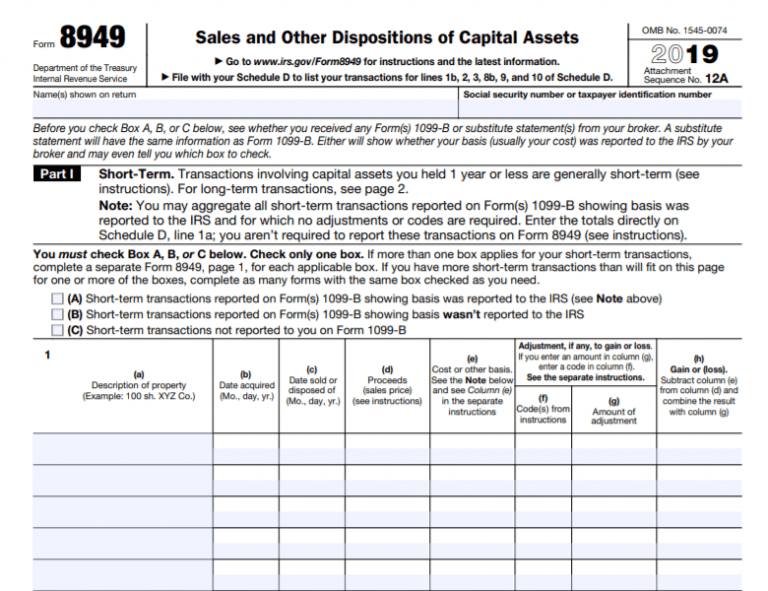

2025 Form IRS 8949 Fill Online, Printable, Fillable, Blank pdfFiller, If you exchange or sell capital assets, report them on your federal tax return using form 8949: Don't enter “available upon request” and summary totals in lieu of reporting the details of each transaction on part i or ii or attached statements.

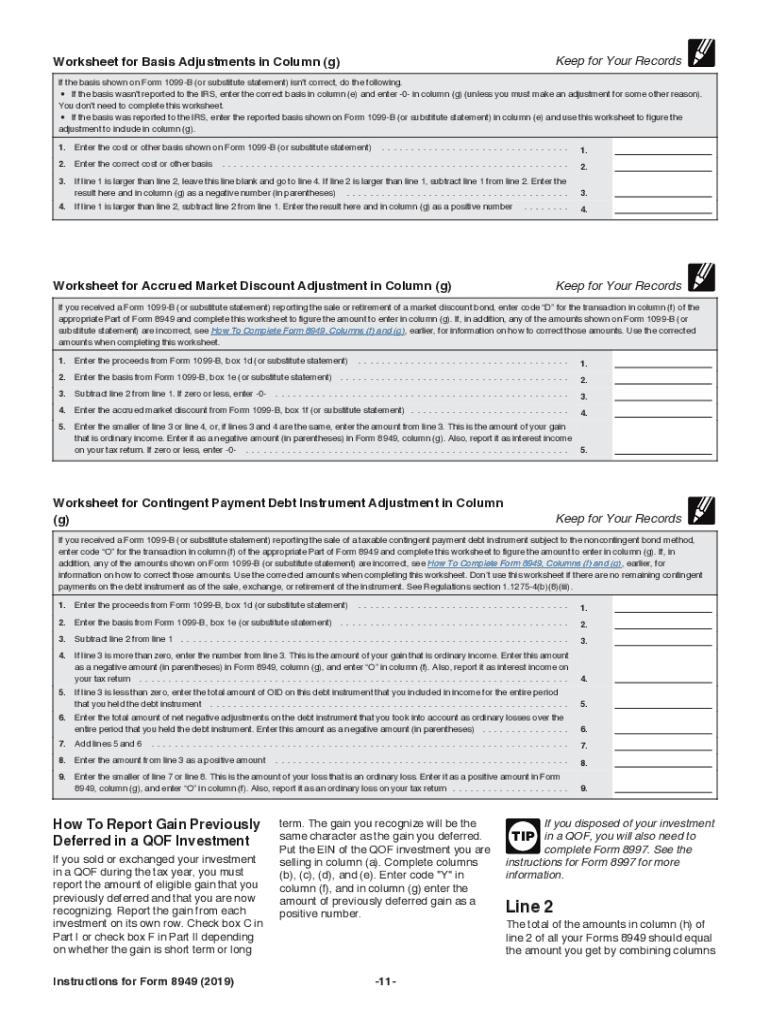

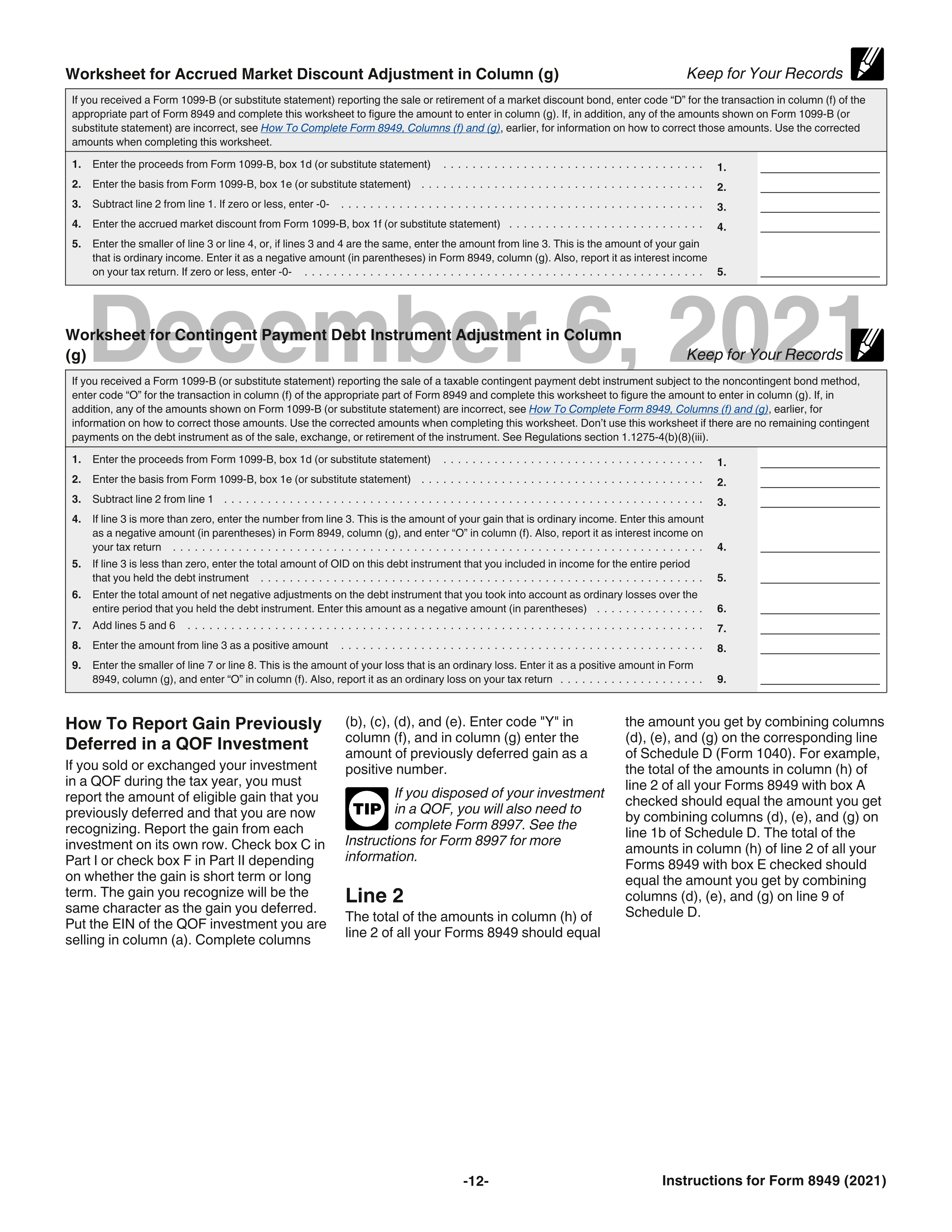

IRS 8949 2023 Form Printable Blank PDF Online, If you exchange or sell capital assets, report them on your federal tax return using form 8949: 17 rows use the worksheet for accrued market discount adjustment in column (g) in the irs instructions for form 8949 to figure the amount to enter in column (g).

In the following Form 8949 example,the highlighted section below shows, The instructions for the form, 8949 is the most authoritative answer you will find and one can always use these as basis for defense in case of any challenge by the. 2025 tax returns are expected to be due in april 2026.

Form 8949 Example Filled Out Fill Out and Sign Printable PDF Template, Irs form 8949 helps you and the irs reconcile your capital gains and losses. Draft versions of tax forms, instructions, and publications.

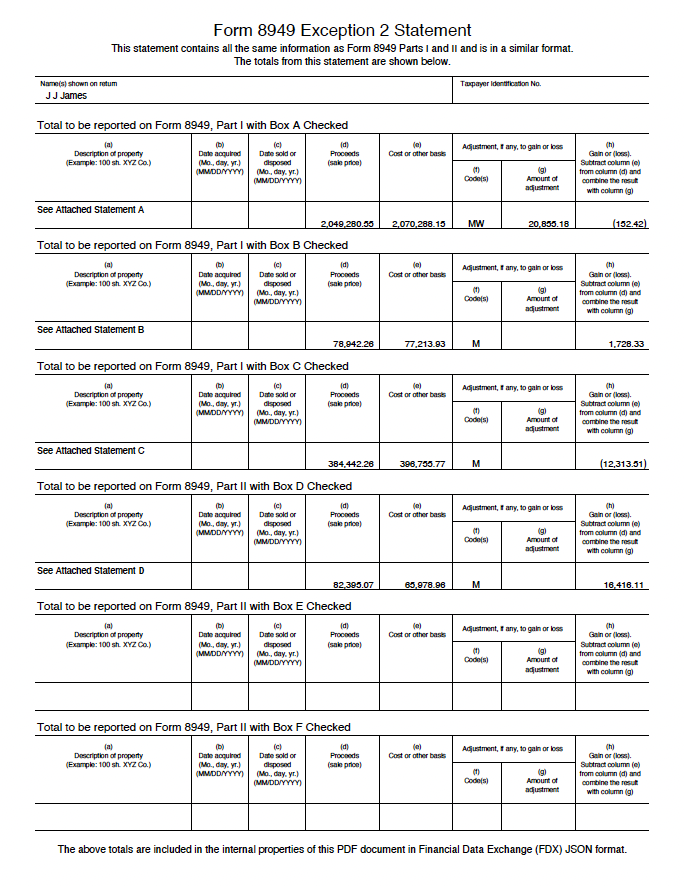

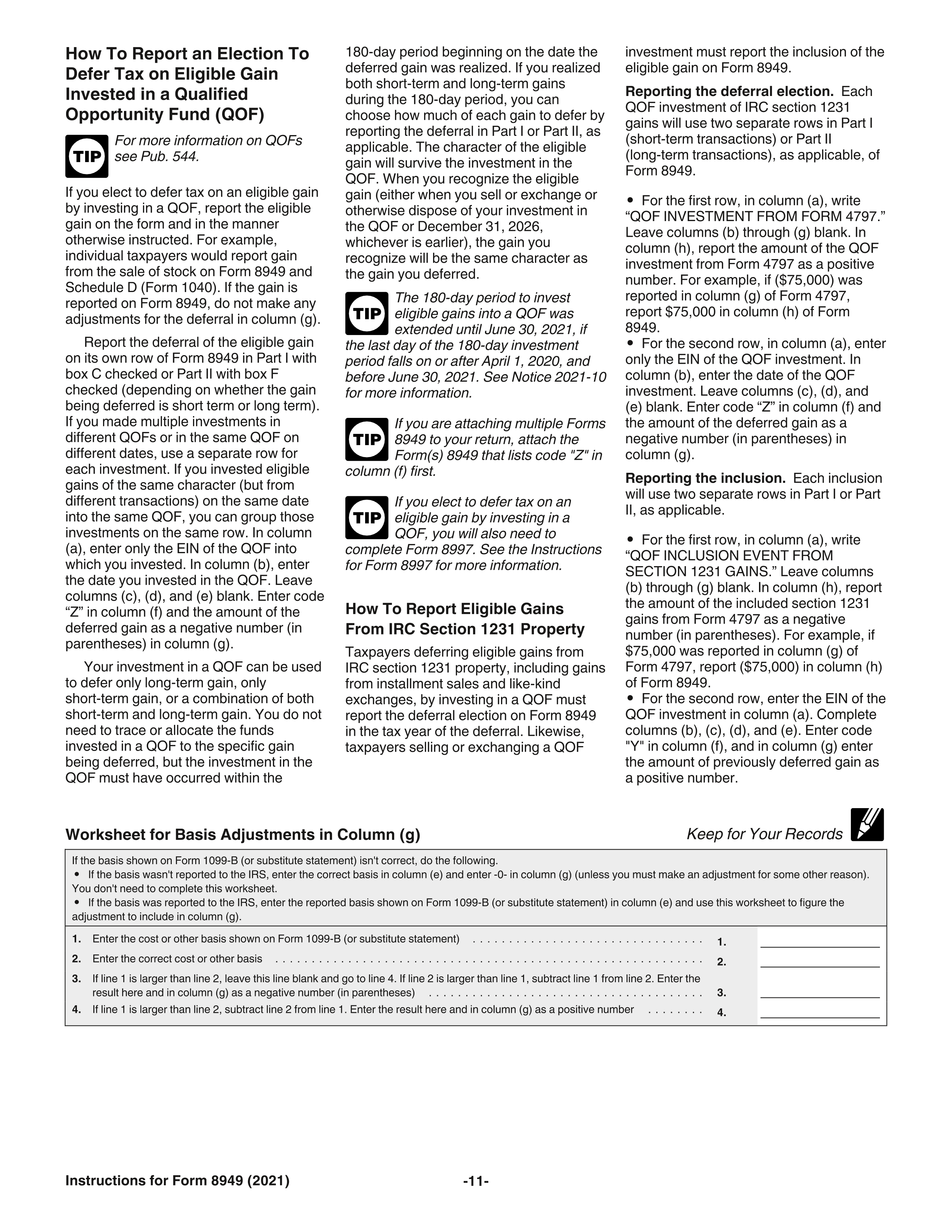

Explanation of IRS Form 8949 Exception 2, The instructions for form 8949 say: This document offers comprehensive guidance on completing form 8949, covering various scenarios like sales and exchanges of capital assets, reporting gains.

2025 Irs Form 8949. The irs has introduced a new tax form (form 8949) for reporting capital gains and losses from stocks, bonds, mutual funds and similar investments. Form 8949 is where you report crypto sales and gains generated.

Refer to form 8949 instructions for a complete list of transactions that you'll need to report on form 8949.

IRS Form 8949 Instructions, If you exchange or sell capital assets, report them on your federal tax return using form 8949: This is a great question!

What is the IRS Form 8949 and Do You Need It? The Handy Tax Guy, The irs has introduced a new tax form (form 8949) for reporting capital gains and losses from stocks, bonds, mutual funds and similar investments. The irs compares the information you.

IRS Form 8949 Instructions, It’s a place to record all stock sales. You can find supplemental materials detailing all taxable dispositions for the year to complete your irs 8949, which includes date.